LTI AT CROWN CASTLE

Time-based RSUs.

Time-based restricted stock units (RSUs) are a type of long-term incentive that are awarded to you in the form of company shares of stock. As the RSUs vest, they become yours over time.

How it works.

You receive an LTI award that includes time-based RSUs and accept the grant.

As RSUs vest, they convert to shares of company stock in your name and are delivered to your personal Charles Schwab account. Note: Tax laws vary by country.

You can sell shares or choose to hold for even greater growth (if the stock price increases).

How LTI vests.

You deserve frequent opportunities to share in the company’s success.

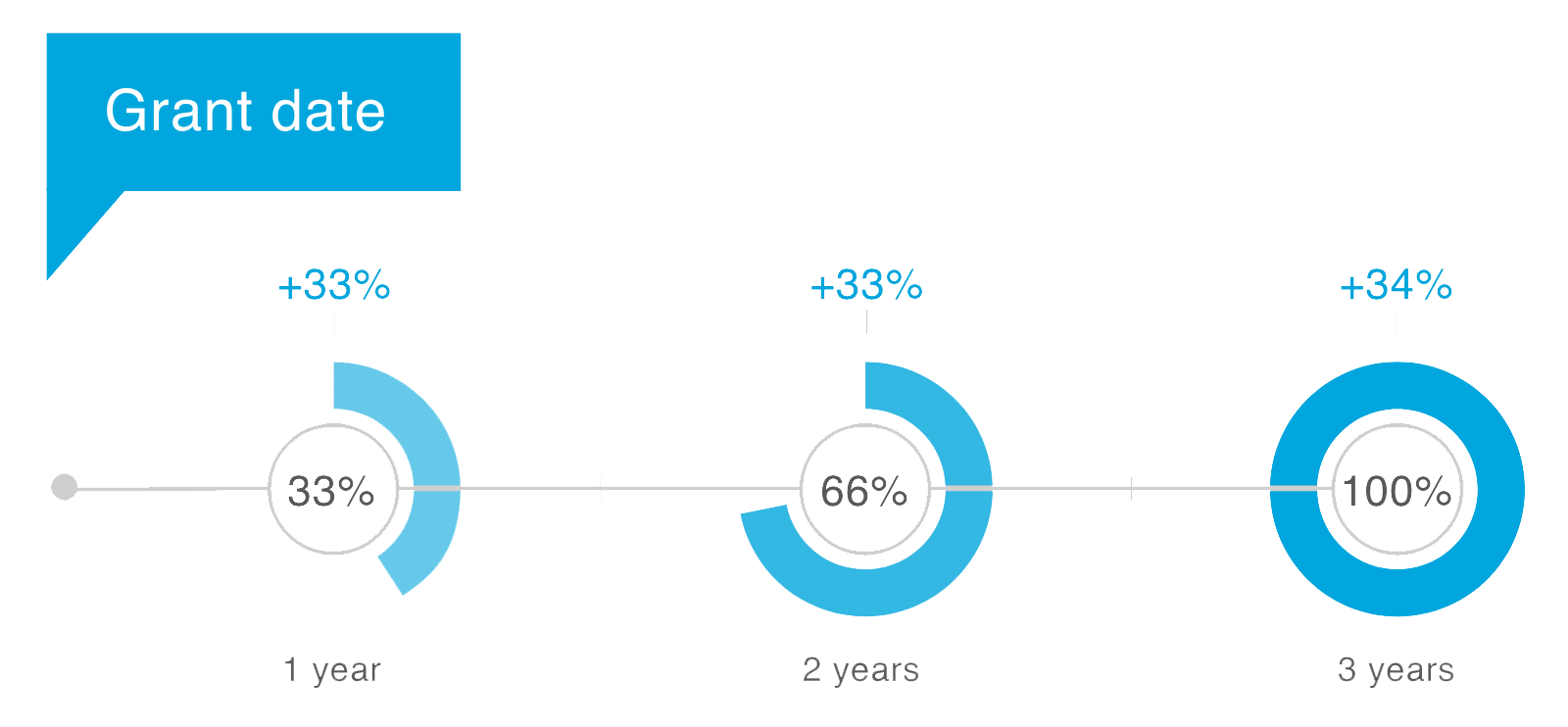

You earn rights to the shares of stock represented by your LTI award in regular increments over time. It’s not an “all or nothing” proposition. Starting in 12 months, our Time-based RSUs vest across 3 years: 33.33% at 1 year, 33.33% at 2 years and 33.33% at 3 years.

-

FOR

EXAMPLEExample for education purposes only. Fictional past performance is no guarantee of future results.

You received a $20,000 LTI award delivered as time-based RSUs. The company stock price was $133.33 per share, so the award was equal to 150 shares.

-

The company stock price rose to $160 per share over the next 3 years.

-

When the shares

fully vested you decided to sell them.Fully vested means the shares are now 100% yours. ,

-

In this example, a $20,000 LTI award increased by $4,000 (+20% change) when it fully vested.

Multiply the shares (120) by the market price ($200) for a total value of $24,000, minus taxes.

KEY FEATURES

-

Regular Vesting

Our RSUs vest and are delivered to your personal Charles Schwab account in regular intervals of time, so you gain ownership in regular intervals

-

Stable Value

Once vested, your award converts to the number of shares issued on your grant date. Depending on trading prices when you sell, actual value can be more or less than the dollar value estimated originally when the award was issued